Optimal Selection of Portfolio in Nigerian Stock Exchange using Dynamic Programming

DOI:

Keywords:

Dynamic Programming, Stock Exchange, Portfolio selection, Investment returnAbstract

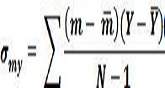

Investment in various types of assets is an exciting choice of most successful business entrepreneurs. Investors have no option than to make a holistic decision regarding the position of their wealth within the context of the portfolio. In this paper, a Dynamic Programming (DP) algorithm and Modern Portfolio Theory (MPT) were used to determine the optimal returns of investments and the risks involved. Also, the correlation between expected returns and risk of investments were analyzed. Data of four securities were collected from the Nigeria Stock Exchange, Yola, for the sample period of 2016. Dynamic programming was found to be a more efficient algorithm for determining how much to invest in each investment portfolio. Through the analysis of the investments, OANDO PLC and Nigeria Breweries were respectively selected with high optimal returns of N426000. That is, investing N5 million in OANDO PLC yields a return of N269000 and N4 million in Nigeria Breweries yields N160000. One observation about these investments is that they all have a high risk of investment.

Contact Us

Contact Us Editorial Team

Editorial Team Join As A Reviewer

Join As A Reviewer  Request For Print Copy

Request For Print Copy

Cprint Publishers

Cprint Publishers